Your African Investment Partner

Who is Synergos Venture Partners?

“Unlocking the best investment opportunities Africa has to offer!”

Synergos Venture Partners is a pan-African investment platform dedicated to unlocking the full potential of Africa’s entrepreneurial ecosystems by bridging capital, capacity, and collaboration. Rooted in deep local insight across 30 Sub-Saharan African countries and backed by global investment expertise, Synergos identifies and structures high-impact opportunities that combine commercial returns with sustainable development. Through partnerships with leading ecosystem actors and a presence in both Africa and Silicon Valley, Synergos catalyzes scalable ventures — from early-stage growth businesses to transformative real estate projects — creating long-term value for investors, entrepreneurs, and communities alike.

Our Partners

True to its name — derived from the Greek synergos, meaning “working together” — Synergos Venture Partners is built on the belief that transformative impact in Africa requires collaborative strength. Our mission is to create a whole that is greater than the sum of its parts by forging strategic partnerships with leading entrepreneurial development organizations across the continent. Through these alliances, we amplify reach, deepen local insight, and accelerate the success of high-potential ventures, collectively shaping a more inclusive and scalable investment landscape.

"The World's Leading Investor Accelerator For Venture Capital, Private Equity, & Angel Investing"

Venture University

Venture University's investor accelerator disrupts the traditional college and MBA education system by offering a program that enables individuals to learn by doing. Venture University receives over 5,000 applications per cohort and accepts only ~45 individuals, resulting in a 0.9% acceptance rate, which is harder to achieve than gaining admission to an Ivy League school or a top MBA program. The individualswhot participate in Venture University focus on deal sourcing, investment evaluation, and doing due diligence before making their investments, and as such share in the financial upside from the investments made. After VU, the individuals go on to join and launch other investment funds, creating a proprietary investor network for deal flow and portfolio support. Currently, the alumni network is ~300 investors and will be growing to 1,000+ investors over the next few years.

"The most scalable venture fund in the world, built to generate consistent and superior returns"

VU Venture Partners

VU Venture Partners is a multi-stage investment fund that is stage- and industry-agnostic. VU leverages its vast network of investors, both traditional and institutional, to help our portfolio companies and their founders find subsequent rounds of funding. By leveraging the investor accelerator of Venture University, VU Venture Partners is investing in promising startups.

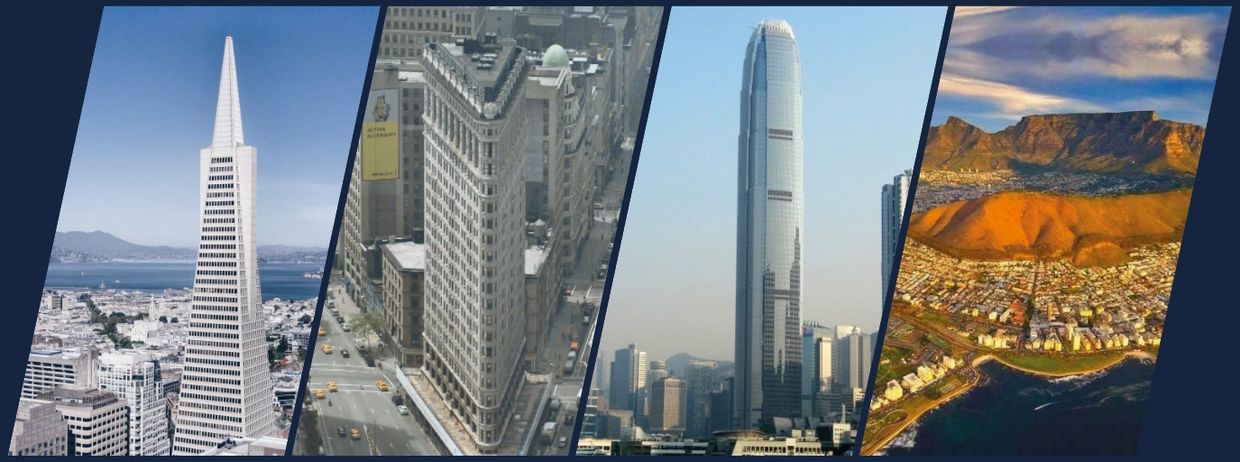

VU Venture Partners has achieved unprecedented scale with an investment team of over 300 investors operating in San Francisco, New York, and Hong Kong.

Office Locations

1700 Montgomery St, Suite 440, San Francisco, CA 94111

245 5th Ave, Suite 1003, New York, NY 10016

The Workst@tion, 43 Lyndhurst Terrace, Central, Hong Kong

Friesland Farm, Blaauwklippen Road, Stellenbosch, South Africa

Synergos Venture Partners